Remember the old style credit cards and how banks were passing them out like hard candy? Remember the raised letters and numbers, with your name, account code and expiration date right there for anyone to see? In those days it didn’t take sophisticated finance fraud rings to steal a persons identiy. After cross referencing a few numbers even an amature could run up your balances, drain your cash accounts and tsunami your credit. Remember how banks and bank executives acted surprised?

By the time the feds caught up to this Wild West style of consumer lending the craziness of the system was out of control. Many consumers were carrying twenty, thirty, even forty credit cards. With the help of mobile-web based credit management software like CyberSoft, TransFair and ReBalance, juggling automatic payments, balance transfers, fees and interest rates was easy and excessive credit card use spiked to unprecedented levels. At the time the Feds were seizing control of the four financial giants – GE Merrill Lynch, Exxon Morgan Chase, Raytheon-Sachs, and Wall Street’s Russian counter-part, Banko Viodnov-Halliburton – they had run the consumer credit industry into the ground while the banks were making nearly 48% of their profits from inflated interest rates, penalties and processing fees. The US Banking Regulation Act #22069 of 2019, which established such psychotically suspect terms such as “Credit Default Immunity” and “Structured Interest Doubling”, would eventually slow the steroid-like growth.

Bob Undare, Senior Director, Credit Default Immunity at Exxon-Morgan-Chase transfers 100s of millions of dollars in credit card fees.

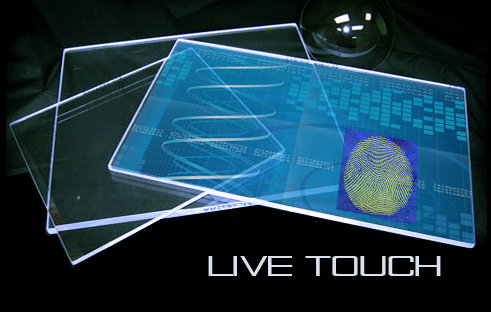

Consumers soon moved on to better solutions. People began adding NFC capabilities to their mobile phones. Proximity sensor transactions swarmed over retail sales environments like invisible locusts, each sale contributing to the greater purpose. People could pay for everything from dinner to airline tickets with a swipe of their mobile phone. Now the banks are back with a completely new credit card. “Live Touch”. It is a new look with a new system of consumer protections and a whole new approach to preventing identity theft. The card is clear and blank. It has no recognizable characteristics of a credit card. The clear material is embedded with an electrochromic, metal-hydride emulsion that’s triggered by a suspended particle network (SPN) that creates the electrode charge when held by the card holder. Your fingerprint activates the authentication and authorization process. All information is encoded and encrypted with real time updates every 72 hours.

Live Touch has brought the credit card back. The card is completely clear until it’s held by the card holder, it’s your fingerprint authorizes and activates it. All your information is encoded and encrypted with real time updates every 72 hours.

The nanotechnology of authentication is simple – triggered by the warmth of your fingertips the card processes a complex series of algorhythm routines and subroutines to capture and distinguish the fingerprint data and determine whether or not the biometric is the authorized user. Detecting, verifying and processing millions of these varying sequences is a little more complex. Live Touch cards are estimated to make $7B over the next two years for the banking industry.

Spokesman for the Bankers Association Dick Beloch said in a closed press conference, “Running a tighter ship is very time-consuming and complicated for us”.

Thanks Dick, brilliant insight. So far no one seems to be too busted up over their predicament.